The district court granted final approval to a settlement of 554 billion in a class action lawsuit called In re Payment Card Interchange Fee and Merchant Discount Antitrust Litigation MDL 1720 MKB JOIn January 2020 certain merchants appealed the courts order to the United States Court of Appeals for the Second Circuit. But some also have bitcoin at their disposal.

Credit Card Payment Processing 101 Everything Merchants Need To Know Rapyd

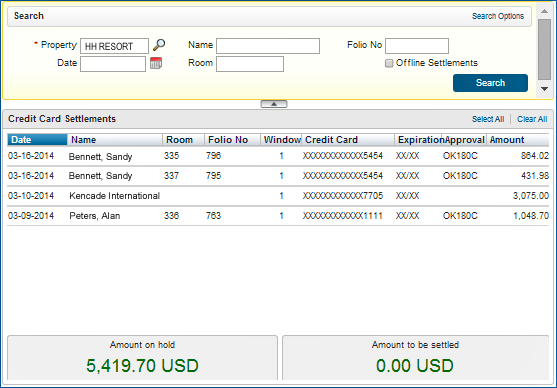

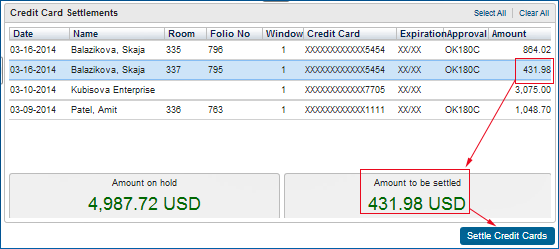

Credit Card Settlements Jump

Authorization Clearing And Settlement Of Mastercard Transactions

Credit card fraud is an inclusive term for fraud committed using a payment card such as a credit card or debit card.

Credit card settlement. It takes a little patience and knowledge of the dispute settlement procedures provided by the Fair Credit Billing Act FCBA. If you cant afford to stay current on your credit card payments debt settlement can reduce the balances and allow you to clear credit card debt in around three to four years. The card issuer usually a bank or credit union creates a revolving account and grants a line of credit to the cardholder from which.

Credit cards and medical bills are ideal for the debt settlement process because if the cardholder files for bankruptcy the card company or medical facility could get nothing. What Is a Judgment. Union Plus Credit Card Program is a rewards credit card for union workers and families.

Credit card debt is typically unsecured debt meaning a credit card company cant come after your assets if you fail to pay what you owe. A settlement is when a credit card company forgives a portion of the amount you owe in exchange for you repaying the remaining amount. Negotiate directly with your credit card company work with a credit counselor or consider bankruptcy.

Talk with your credit card company even if you have been turned down before. Lump-Sum Payment Agreement In this instance you negotiate with the credit card company. Lets look at an example.

The Association determines each banks net debit position. Many debt settlement companies will advise you to purposely fall behind on your payments so creditors will be more willing to accept a settlement payment on the debt. Since credit card companies dont have this recourse many are willing to negotiate a settlement with customers to recoup as much of the debt as possible.

The remaining amount can be repaid in a single payment or over a series of payments. The Settling Defendants will collectively pay a total of CAD 120 million the Settlement Amount for the benefit of the Settlement Class Members in exchange for the dismissal of the Credit Card Actions and other related litigation and a full release of all claims advanced against each of them and their related entities including future claims relating to continuing acts or practices. We are a five-star BBB accredited business and rated Excellent on Trustpilot.

Next learn which credit. Get debt relief and manage online through the Capital One App. Bow Tie Loan.

Settling your credit card debt typically means that you negotiate an agreement to repay a portion of your balance because you are facing hardships that prevent you from repaying the debt in full or if you cannot pay your outstanding balance for other specific reasonsWhile this can help you better control your finances by reducing the debt you owe an official debt settlement may affect your. To improve your odds of being approved for a new account try these steps. Most people have a credit card they can use to pay for things.

Has your credit card company ever charged you twice for the same item or failed to credit a payment to your account. A debt settlement program could resolve 50000 worth of credit card debt for 30602. The purpose may be to obtain goods or services or to make payment to another account which is controlled by a criminal.

Steps 9 and 10. Debt settlement will hurt your credit score more if the credit cards you settle are already in good standing and if you end up settling multiple credit card accounts. Working with a debt settlement company is just one option for dealing with your debt.

While frustrating these errors can be corrected. If you have access to a good amount of cash or can put it together fairly quickly you can try to negotiate a settlement with the credit card company in three payments or less creditors are precluded from offering better than three-month terms if your account has not yet been charged off. A short-term variable-rate loan in which unpaid interest charges above a predetermined interest rate are deferred.

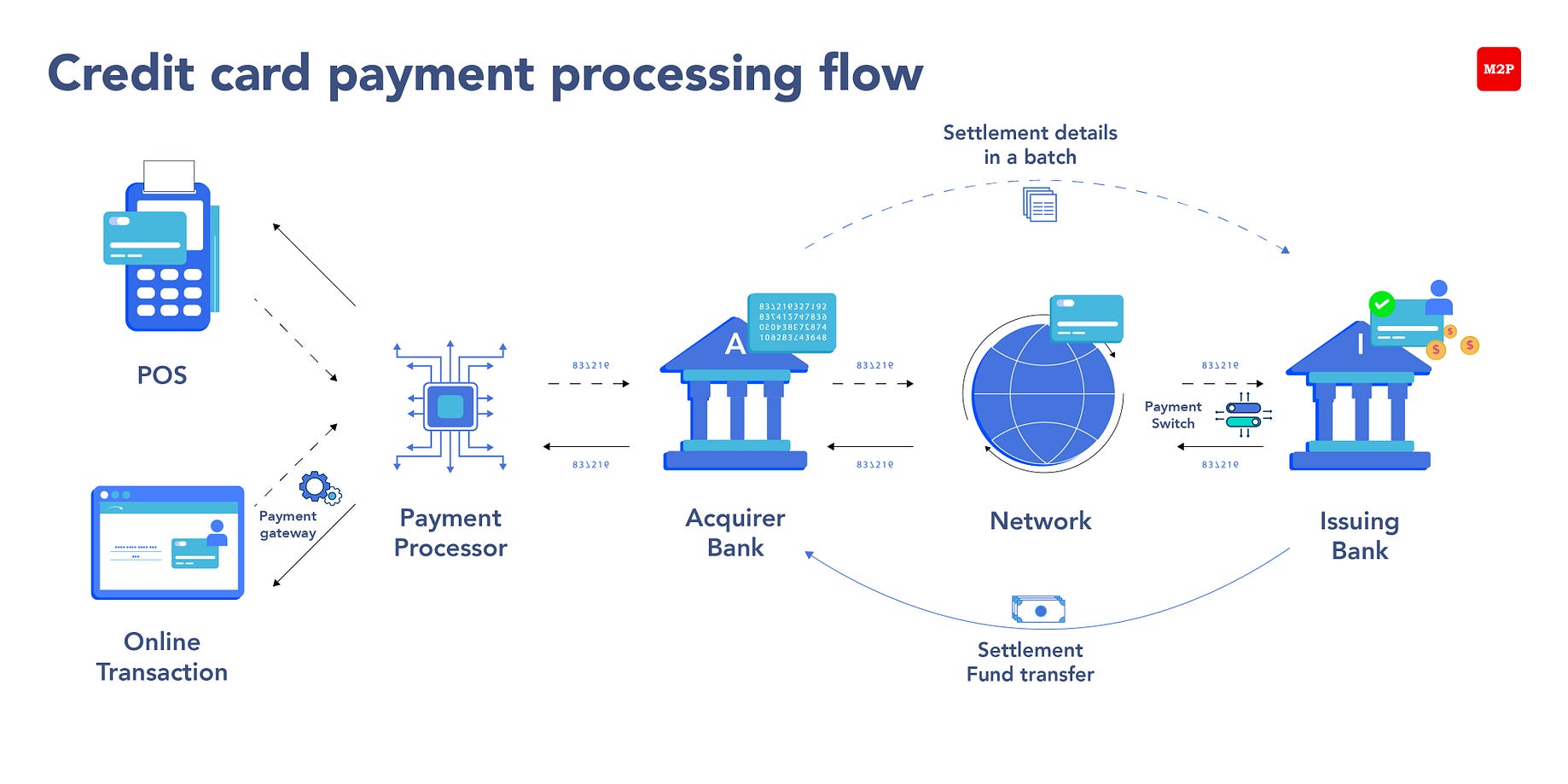

The acquiring bank forwards the sales draft data to the applicable Association which in turn forwards the data to the issuing bank. Read on to learn how a credit card company can get a judgment and what types of collection actions it can take once it gets a credit card judgment. If the credit card company is willing to entertain the idea of a debt settlement then the odds are high that they will want to make one of the following arrangements.

American Credit Card Solutions offers industry leading debt relief and debt settlement solutions. Rejection hurts even when a credit card issuer rejects an application using an automated system. Recent purchases using the card last 6 to 12 months make up a significant portion of the balance owed on the credit card.

If youre ready to tackle improving your credit a credit repair service can help save you time energy and a whole lot of hassle. The Federal Reserve Board says that 71 of credit card debt was 90 days past due in Q4 of 2016. Discover how we have helped people reach financial freedom.

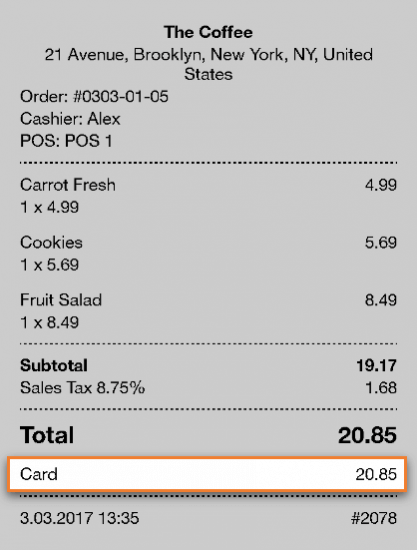

Offer a lump sum settlement. A credit card company can get a judgment against you in several ways after it has filed a lawsuit. Credit card transactions to its bank the acquiring bank in batches or at the end of the day14.

The Payment Card Industry Data Security Standard PCI DSS is the data security standard created to help financial institutions process card payments. If you made a point-of-sale purchase at a Forever 21 store using a credit debit or other payment card you may be eligible for a payment from a class. A judgment is an order entered by a court of law indicating the courts findings.

The 5 Best Credit Repair Companies Updated October 2021. A credit card is a payment card issued to users cardholders to enable the cardholder to pay a merchant for goods and services based on the cardholders accrued debt ie promise to the card issuer to pay them for the amounts plus the other agreed charges. Use of a software package or manually identifying an account for placement with a debt collection attorney with authorization to sue because the account analysis shows you are paying other unsecured creditors other credit card bills.

A variable-rate loan is a loan in which the interest rate. Unfortunately doing so will be awfully expensive with the First PREMIER Bank Mastercard Credit Card thanks to a 36 APR that is considerably higher than the average rate for secured credit cards 179 and cards for people with fair credit 2258 according to WalletHubs latest Credit Card Landscape Report.

Faq How Do I Settle Credit Card Transactions

/negotiating-credit-card-debt-settlement-5976c779b501e800119259c4.jpg)

How To Negotiate Credit Card Debt

Credit Card Debt Settlement How To Negotiate It Yourself Finder

How To Work With Credit Card Payments Loyverse Help Center

Credit Card Processing A Definitive Guide M2p Fintech

Credit Card Batch Settlements Cc Batch Settlements With Gen1 Fmx

How Long Does A Credit Card Payment Take To Process Ccbill Blog

.png)

Credit Card Payment Loses Ground In More Markets The Asian Banker