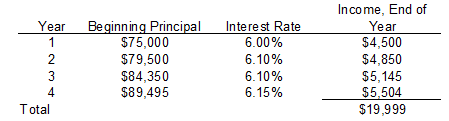

Over that time span the money earns interest which you can withdraw at the end of the term. Multi-account CICD deployment.

Join Bank Cd Accounting Play And Learn More

Is Now A Good Time To Open A Cd

Simplifying Multi Account Ci Cd Deployments Using Aws Proton Aws Architecture Blog

The CodeCommit repository to store the source code for the API.

What is a cd account. In exchange you agree to keep the full deposit. Your rate will be fixed on the business day we receive your completed application provided we receive your deposit within 30 days after your application is approved. IAM roles and policies required for the CodePipeline and CodeBuild projects.

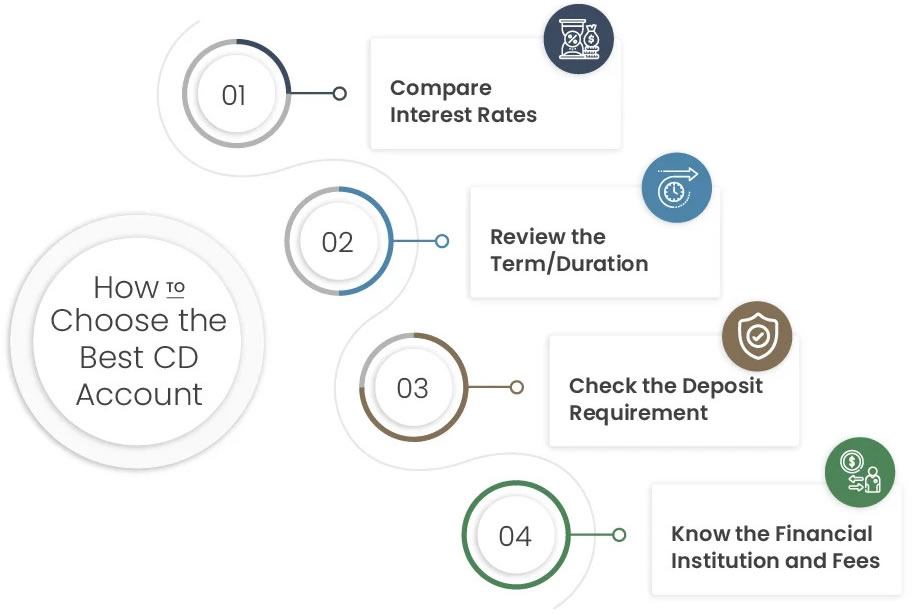

Find the right fixed-rate CD for your needs. There are a number of reasons you may want to open a CD. Your interest rate APY and the applicable benefits tier may change while enrolled in the Relationship Package.

Password can not be empty New artist sign up. For a CD account rates are subject to change at any time without notice before the account is opened. For CD accounts longer than 12 months the penalty for withdrawing early is 6 months of interest.

For 12 month CD accounts or less the penalty for withdrawing early is 3 months of interest. There are no monthly fees and you get the piece of mind of FDIC and DIF insurance to protect your entire balance. CDs typically pay higher interest rates than other deposit products.

During the specified time period your money is deposited you will earn a certain APY for your specific CD account. Learn more from Better Money Habits about how CDs work and how they can help you reach your savings goals. When the CD is closed the funds can be distributed through an ACH transfer a wire transfer or a certified check.

CDs generally pay a fixed rate of interest and can offer a higher interest rate than other types of deposit accounts depending on the market. CDs or Certificate of Deposit is a certificate issued by the bank to a person depositing their money for a specific amount of time. A certificate of deposit CD is a type of FDIC-insured deposit account offered by many banks and credit unions that usually has a fixed interest rate over a certain number of months or years.

Generally banks will only expect to hear from CD holders when a CD matures as that is the opportunity to make withdrawals deposits or other changes to the account. Sign up now to start selling your music worldwide. Learn more about our certificate of deposit terms today.

Your browsers cookies are disabled. Committed to helping customers reach their financial goals. A certificate of deposit that allows the bearer to deposit additional funds after the initial purchase date that will bear the same rate of interest.

A CD from SalemFive Direct is an easy way to be smart about your savings. An early withdrawal penalty applies on the amount withdrawn. Its FDIC-insured and if you dont need.

Our high yield CD account guarantees you returns when you lock in your term of 3 months up to 10 Years. When you open a CD you agree to leave money in the account for a specific period of time. Partial early withdrawals of principal are allowed without the CD account being closed.

However like with any CD account there is a penalty for withdrawal prior to the end of your CD term. You create the CICD pipeline in the tools account using the CloudFormation template which provisions the following required resources. The interest rate on your account is the initial base interest rate stated on your CD Signature Card plus a bonus interest rate if applicable.

A certificate of deposit CD is a low-risk savings tool that can boost the amount you earn in interest while keeping your money invested in a relatively safe way. Creating the CICD pipeline in the tools account. Learn more about your savings options from Bank of America including savings accounts CD accounts and child savings accounts.

A CD certificate of deposit is a type of deposit account thats payable at the end of a specified amount of time referred to as the term. Interest can be redeposited to the CD to a checking account to a savings account or paid to you via check. It may make sense to have both a savings account and a CD as part of your overall savings plan.

A CD or certificate of deposit is a type of savings account found at banks and credit unions that pays a fixed interest rate on money deposited. Your CD will mature on a specific date have a specified fixed interest rate and can be issued in any denomination above 1000. Open Your CD Account Today.

A CD is a great savings tool for your long-term financial goals. Additional accounts may be added based on your use case and security requirements. The AWS Proton management account development account and production environment accounts.

At maturity theres a 10-day grace period which is a typical length. A CD is a type of deposit account that can pay a higher interest rate than a standard savings account in exchange for restricting access to your funds during the CD term often between three. For Figures 3 and 4 we used publicly available templates and created three separate AWS accounts.

Create a new account. Open a CD and deposit at least 500 within the first 10 days. We stand by our high-yield CDs with a 10-Day CD Rate Guarantee.

If the rate on your selected CD term goes up during this time youll get that rate automatically. Try our CD Calculator below to see how much your savings could grow. When interest rates fluctuate you can be confident that you have a guaranteed rate of return on the money youve placed in your Live Oak CD account.

Please reenable cookies to continue. Open an account online in just minutes. New to CD Baby.

Marcus by Goldman Sachs provides no-fee personal loans high-yield online savings for individuals. Higher CD rates may be available for longer terms or larger deposited amounts. A certificate of deposit or CD is a type of savings account.

Add-On Certificate of Deposit.

Hatboro Federal Savings Cd Rates 11 2021

Your Guide To Cd Accounts And Finding The Best Rate Investinganswers

What Is A Cd Account And How Does It Work Finance Career

Cd Ladder Definition Example Investinganswers

What To Know Before Getting A Cd No Not A Compact Disk Wealthry

Haven Savings Bank Cd Account Review 0 25 To 1 60 Apy Cd Rates Nationwide

What Is A Cd Certificate Of Deposit Account And How Do They Work

Cd Vs Savings Account Which Type Is Right For You